Introduction — Why this matters now

Hearing aid insurance options aren’t all worth paying for—and some plans quietly cost more than they save. This is where many buyers get stuck: insurance brochures promise “coverage,” but the fine print reveals caps, brand restrictions, or provider rules that erase most of the benefit.

Because hearing aids remain excluded from Original Medicare, private insurance, employer benefits, and supplemental plans have stepped in—unevenly. This article breaks down which hearing aid insurance options actually reduce out-of-pocket costs, which ones add complexity without real value, and how to evaluate a plan before you commit. The goal is practical savings, not just the word “covered.”

The 40-Second Answer

The most helpful hearing aid insurance options are employer-sponsored benefits, some Medicare Advantage plans, and select private plans with clear dollar allowances. Standalone hearing aid “insurance” often offers limited value unless you need frequent repairs or replacements.

Hearing Aid Insurance Coverage Basics | 7 Types of Insurance

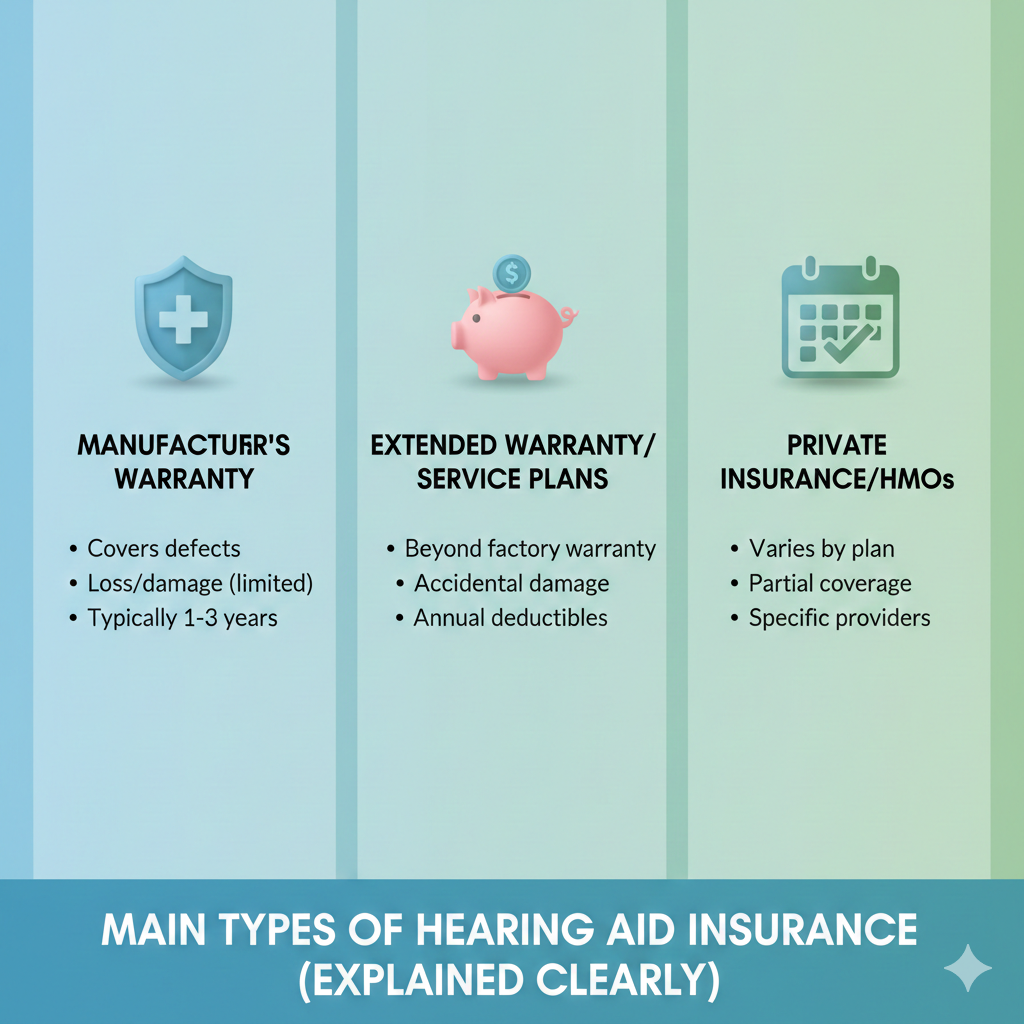

Main Types of Hearing Aid Insurance (Explained Clearly)

1) Employer-Sponsored Health Plans

Some employer plans include hearing benefits—especially larger organizations.

What to look for

Dollar allowance per ear

Replacement frequency (often every 3–5 years)

In-network provider rules

Reality check: These plans often provide the best value when available.

2) Medicare Advantage Plans

As discussed earlier, Advantage plans may include hearing benefits.

Pros

Built-in allowance

Routine hearing exams

Cons

Strict networks

Caps rarely cover full cost

[Expert Warning]

Advantage plan benefits change yearly—always recheck coverage during open enrollment.

3) Private Health Insurance

Some private plans include limited hearing aid benefits.

Common limitations

One-time lifetime allowance

Specific brands only

Age restrictions

Private coverage helps most when paired with mid-tier devices—not premium upgrades.

4) Supplemental & Discount Programs

These include association plans, retail discount networks, or add-on coverage.

Be cautious

Discounts are not insurance

Savings vary widely

Limited provider choice

[Pro-Tip]

Always compare “discounted price” to OTC alternatives—you may save more without the plan.

Common Insurance Pitfalls (and How to Avoid Them)

Pitfall #1: Confusing discounts with coverage

Fix: Ask for a dollar amount, not a percentage.

Pitfall #2: Ignoring provider networks

Fix: Confirm your preferred clinic or retailer is in-network.

Pitfall #3: Paying premiums for rare use

Fix: Calculate total premiums vs expected benefit.

Information Gain: When Insurance Actually Costs More

Most SERP articles assume insurance always helps. In practice, some plans:

Require monthly premiums that exceed benefits

Lock you into higher-priced providers

Limit you to brands with costly upgrades

For users with mild loss eligible for OTC hearing aids, insurance can increase total spending rather than reduce it.

Unique Section — Practical Insight From Experience

Many buyers only realize the limits after choosing a device.

A smarter approach:

Get your hearing profile

Price OTC and clinic options

Then see if insurance reduces that number meaningfully

Reverse the order, and you risk forcing your needs into the plan instead of the other way around.

Real-World Scenarios

Scenario A: Employer Plan With Allowance

Covers part of mid-tier device

Out-of-pocket reduced significantly

Scenario B: Supplemental Plan Only

Monthly premiums exceed benefit

OTC option cheaper overall

Same hearing loss. Different math.

Insurance Options Compared (Table)

| Insurance Type | Helps Most When | Watch Outs |

| Employer plan | Active coverage exists | Network limits |

| Medicare Advantage | Included benefit | Low caps |

| Private insurance | Clear allowance | Brand restrictions |

| Discount programs | OTC not suitable | Not true coverage |

[Money-Saving Recommendation]

If a plan doesn’t clearly lower your total 3-year cost, skip it.

Internal Linking (Contextual)

“how pricing models affect insurance value” → How Much Do Hearing Aids Really Cost?

“Medicare hearing benefits explained” → Does Medicare Cover Hearing Aids?

“budget-friendly alternatives” → Best Affordable Hearing Aids

Watch & Learn (YouTube — contextual)

“Hearing aid insurance explained simply”

“Medicare Advantage vs private hearing benefits”

(Embed after the insurance types section.)

Image & Infographic Suggestions

Infographic: “Which Insurance Options Actually Save Money”

Alt: hearing aid insurance options comparison

Diagram: “Premiums vs Benefits Over Time”

Alt: hearing aid insurance cost analysis

Visual: “Insurance vs OTC Decision Flow”

Alt: hearing aid insurance decision guide

FAQs

Is hearing aid insurance worth it?

Sometimes—only if benefits exceed premiums.

Do employer plans cover hearing aids?

Some do, especially larger employers.

Are discount programs real insurance?

No—they reduce price but don’t insure devices.

Can insurance be used for OTC hearing aids?

Rarely—most OTC purchases are out of pocket.

Should I buy insurance before choosing a hearing aid?

No—choose the device first, then see if insurance helps.

Conclusion

Insurance can help with hearing aid costs—but only when the math works in your favor. Clear allowances, usable networks, and realistic caps matter more than the word “covered.” When insurance reduces total cost, use it. When it doesn’t, simpler options often win.

Internal link

Does Medicare Cover Hearing Aids? What Applies

External link